Do You See What We See?

Emotional Risk Management

If a trader wants to make money consistently, they need to manage risk. However, most traders rarely consider emotion as a specific risk that needs management. It has been demonstrated by behavioral finance researchers such as Dan Kahneman, Ph.D. that surges of emotional reactivity can negatively bias cognitive decision making resulting in significant losses for traders.

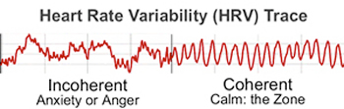

Coherence is Solution

When a trader is in the grip of a volatile emotional waves like fear or anger, physiologically their nervous system looks “choppy” like the chart depicts above. In contrast, when a trader is in an optimal state of balance, the chart of their nervous system looks “smooth” or coherent. Emotional Risk Management aims to assist traders in shifting from a choppy to a smooth rhythm and translates to increased confidence, better performance, and higher profit potential.

Emotion & Money

Could the fear of losing money keep you from making money? Scientists studying investment behaviors say emotions may be what are behind the average person's failure to master the market. Check out this ScienCentral News video for perspective.

Fear and the Brain Biofeedback & Traders

Skills of Top Traders

Attention is Focused - Emotions are Even - Pressure is Managed

No trader can perform optimally without attending to trade-relevant cues. To understand what is involved in paying attention, you need to know that:

-

★Focus of concentration constantly shifts in response to changing performance demands. The ability to make appropriate shifts is one of the building blocks of concentration.

-

★The shifts in concentration or focus of attention occur along two intersecting dimensions, a dimension of width and a dimension of direction.

At any given point in time, focus of concentration falls into one of the four quadrants shown below. Each of the four types of concentration represents a basic building block of concentration.

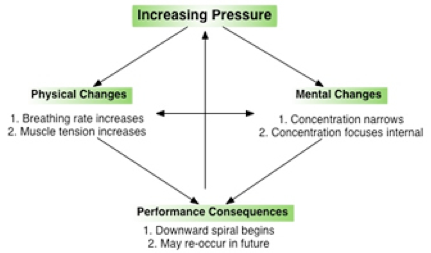

Fluctuations in emotional arousal has a predictable effect on a trader's focus of attention and on the ability to shift back and forth between the different types of concentration. This relationship is reciprocal; a trader's focus of concentration can have a controlling effect on emotional arousal. An understanding of the relationship between attention and arousal, and the conditions that impede a trader's ability to control emotions and concentration, is critical in the design of effective intervention and training programs.

Here’s what happens physically and mentally when a trader becomes stressed in a performance situation.

Deliberate Practice Makes Perfect

THERE ARE NO ORDINARY MOMENTS

"To survive the lessons ahead, you're going to need far more energy than ever before," Socrates warned him that night. "You must cleanse your body of tension, free your mind of stagnant knowledge, and open your heart to the energy of true emotion."

-From The Way of the Peaceful Warrior, by Dan Millman

way of the Peaceful Warrior

Golf, like trading requires mental preparation, practice, and trusted execution rooted in a decisive mind that has no fear. Tiger Woods epitomizes this sequence of excellence and his description of entering “The Zone” while hitting a golf shot captures what happens to the mind & body when it is totally absorbed in the “now moment opportunity flow.”

Way OF A Deliberate TIGER